Table Of Content

Her work has been published by several insurance, personal finance and investment-focused publications, including Jerry, BiggerPockets, 401(k) Specialist, BP Wealth and more. Homeowners insurance is a form of property insurance that protects your home and personal belongings in the event they're destroyed by a covered loss, like a fire or windstorm. It can also protect your assets in the event you're found legally responsible for someone's injury or damage to their property. However, Travelers offers fewer discounts than most companies of its size, and its scores in J.D. Power’s 2022 customer satisfaction, claims, and digital experience surveys indicate that Travelers’ customer service could use some improvement. Progressive is ideal if you’re looking to purchase home and auto insurance policies at the same time to score discounts on your premiums.

Average Cost of Home Insurance by Company ($750,000 in Dwelling Coverage)

State Farm vs. Farmers Home Insurance (2024) - MarketWatch

State Farm vs. Farmers Home Insurance ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

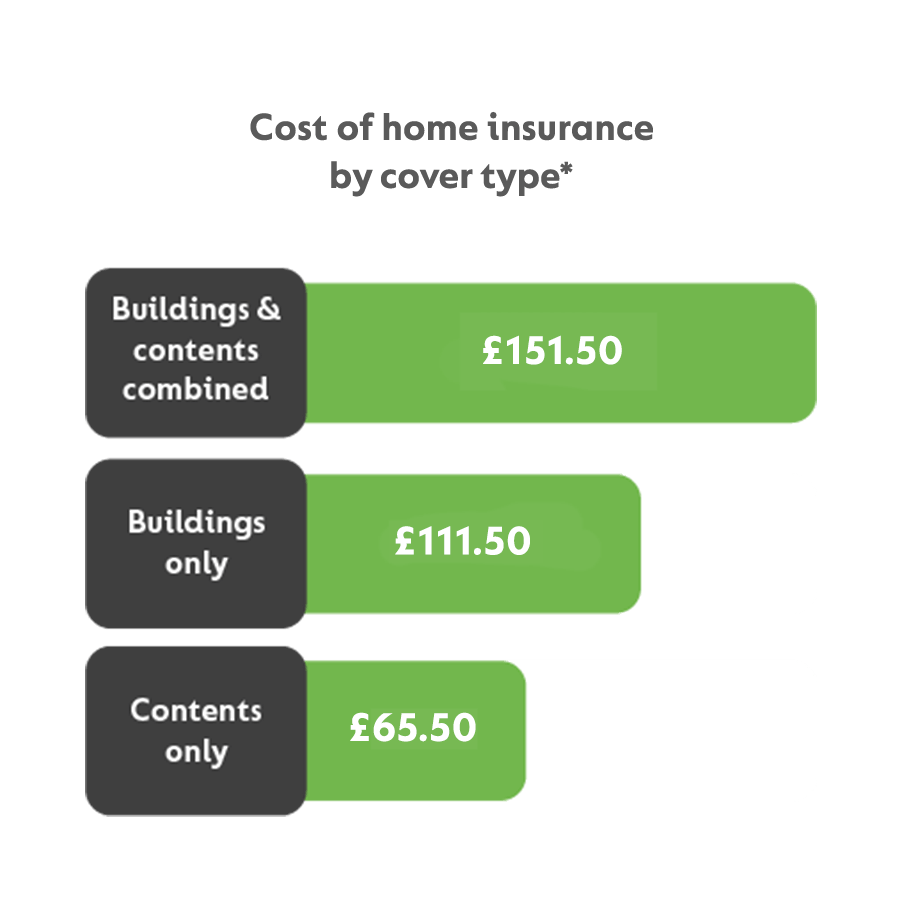

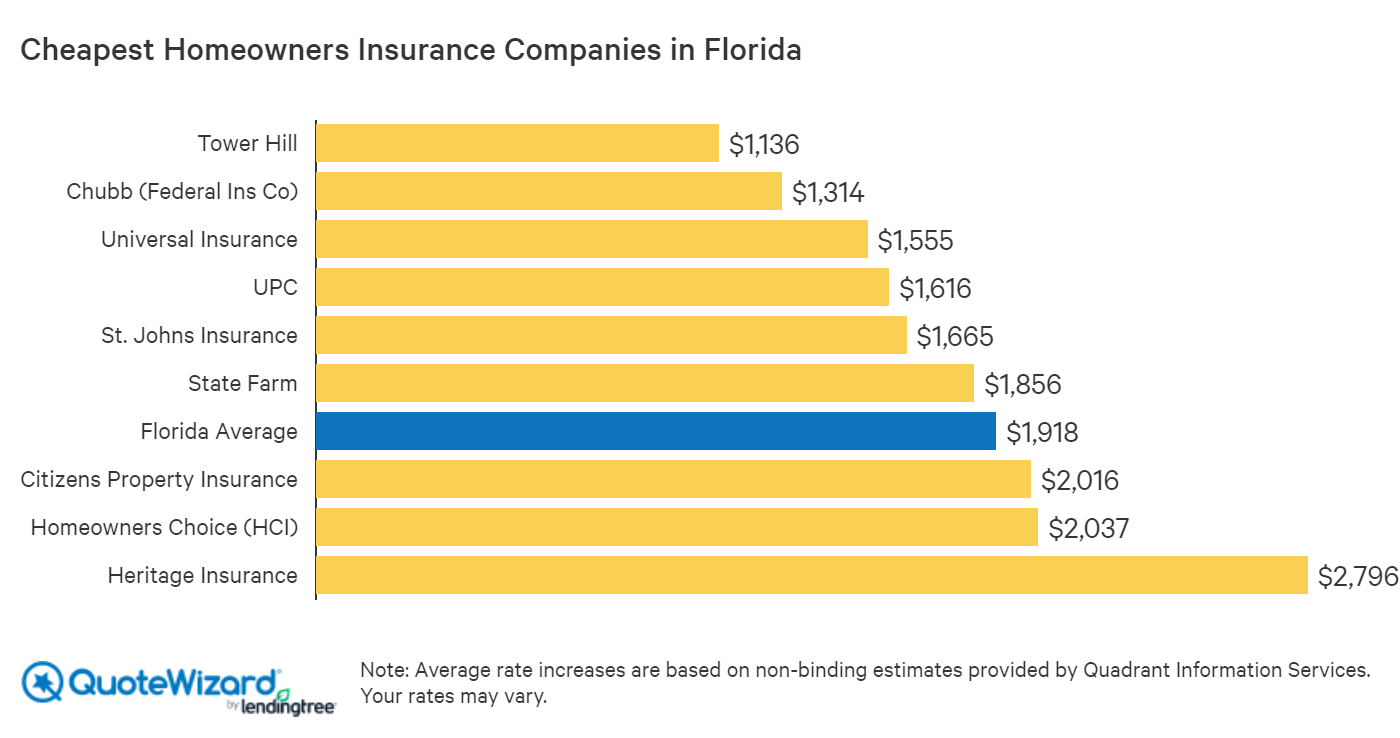

To find the average cost of homeowners insurance, NerdWallet calculated the median rate for 40-year-old homeowners from a variety of insurance companies in every ZIP code across the U.S. In most states, insurers can use your credit-based insurance score (similar to your FICO score) to set rates. Because some studies have shown a correlation between poor credit and filing claims, those with a checkered credit history may pay more for homeowners insurance. Certain renovations — such as updating an electrical or plumbing system — could lower homeowners insurance costs. Getting a new roof could also net you a discount, especially if it’s resistant to wind and/or hail. There are several reasons why home insurance rates have gone up in recent years, including more severe natural disasters, high inflation, fewer carriers offering coverage in high-risk areas, and other factors.

Average Cost of Homeowners Insurance by Deductible Amount

Best Homeowners Insurance in California of April 2024 - MarketWatch

Best Homeowners Insurance in California of April 2024.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Residents who can endure the stifling heat are rewarded with home median home prices at an astonishing $52,000. Both communities in the Riverside-San Bernardino metropolitan area saw home values dip about 17% in the last year. More recently, Searles Valley, which includes Trona, saw its population fall 15% between 2010 and 2022, according to census data. These affordable communities are far-flung and a long drive from the bustle of the city. But locals say the bargain prices and charms make the trade-offs worth it.

How Bankrate chose the cheapest home insurance companies in California

If your house is large or has high-end features, it’ll cost more to rebuild and you’ll need more dwelling coverage. We analyzed prices in 20 of the largest metropolitan areas in the U.S. to find the average homeowners insurance cost in each city. Meanwhile, San Jose, California, was the cheapest city on the list, with an average annual rate of $1,055. The information provided on this site has been developed by Policygenius for general informational and educational purposes. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding.

Homeowners insurance costs increased by nearly 11% between 2021 and 2022 according to private banking firm S&P Global, joining the list of necessary services hit by inflation. All these factors often go into determining your replacement cost, and why you may periodically see your homeowners insurance cost change as the market changes. If you rent out a house to tenants or if your rental property is unoccupied, you'll need a dwelling policy rather than a homeowners policy to cover your rental home.

Here’s how filing a claim could affect your homeowners insurance costs. If you have more than $500,000 in assets (the maximum amount offered under most home policies), consider purchasing a personal umbrella insurance policy. Also known simply as umbrella insurance, this is a type of supplemental insurance coverage that acts as a buffer for your policy in case your liability coverage limits aren't high enough to cover the cost of a lawsuit. You can generally purchase up to $5 million (in $1 million increments) in umbrella insurance coverage.

Bankrate

Comparing quotes from top home insurance providers like Allstate, Chubb and State Farm may help you find the right carrier for your needs. His expertise on home and auto insurance has been featured on Forbes, Consumer Affairs, Realtor.com, Apartment Therapy, SFGATE, Bankrate, and Lifehacker. However, most lenders will require proof of home insurance before you can close on a property. Allstate is one of the most popular home insurance providers in the country thanks to several customizable options, unique coverage add-ons like short-term rental coverage, and availability in all 50 states. In addition to deciding how much of each coverage you need, you should also look at how claim settlements are determined when comparing policies from different companies. For a potentially faster and more accurate home insurance quote comparison, consider having the following information on-hand.

The Bankrate promise

An Insure.com analysis of the average cost of home insurance for nearly every ZIP code in the country found that the highest homeowners insurance rates belong to ZIP code in Wrightsville Beach, North Carolina. ZIP codes in Islamorada, Florida, and El Lago, Texas ranked second and third. You can enhance or supplement your standard homeowners insurance policy with additional types of coverage, such as flood insurance or earthquake insurance. If you live in an area prone to flooding, a flood insurance policy may help protect against damage to your home and personal belongings.

Understanding California's FAIR plan

The final insurance policy premium for any policy is determined by the underwriting insurance company following application. If that doesn't sound ideal, most insurance providers will let you upgrade your personal property claim settlements to replacement cost value (RCV) for an additional fee. With RCV coverage, your insurer would reimburse you for the value of a new, similar couch at today's prices.

Loss of use coverage is generally set at 10% to 30% of your dwelling coverage limit. A standard homeowners insurance policy, also known as an HO-3, covers your dwelling (house) for any problem except ones listed as exclusions in the policy. A homeowners policy also covers your personal property, such as furniture and clothes.

Our research determined that the average cost of home insurance in California is $1,403 per year for $300,000 in dwelling coverage. The company will offer coverage “in nearly every corner” of California, Zimmerman said. The testimony marks the first time a large property insurer has publicly promised a return to the market in the disaster-prone state if the new regulations are implemented.

No comments:

Post a Comment